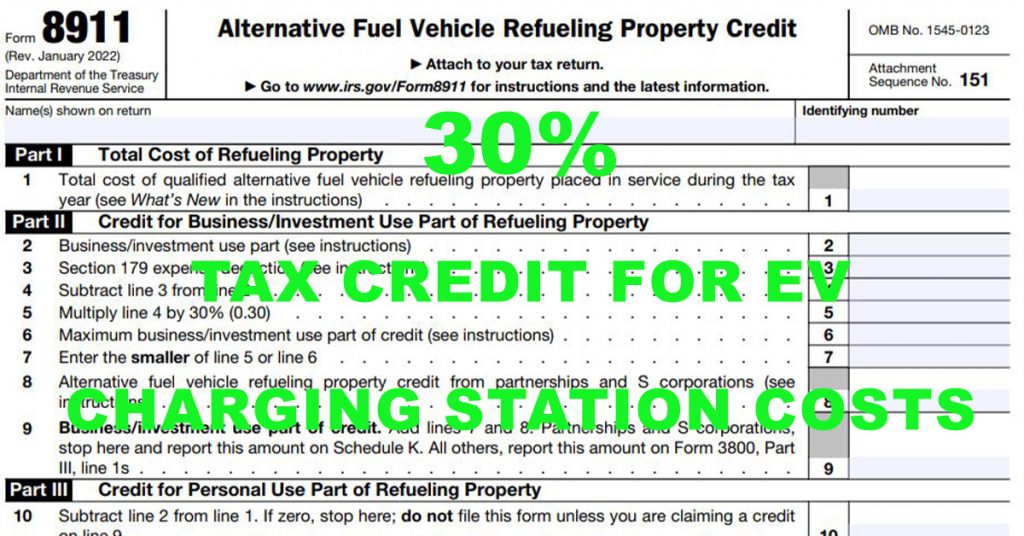

If you installed an EV Charging Station in 2022, you may be eligible for a 30% Federal Tax Credit. The IRS form is 8911 and you can learn more about this credit on the IRS website. It covers 30% of the costs with a maximum $1,000 credit for residents and $30,000 federal tax credit for commercial installs.

The credit includes the materials, labor and any related fee’s.